💰 The Investment Thesis

The dawn of AI as a true discovery engine in biology is here, fundamentally altering the competitive landscape of biotechnology and pharmaceuticals. DeepMind's AlphaFold, now celebrating five years of unparalleled impact, has proven that AI can predict protein structures with atomic accuracy, a feat once deemed impossible and a bottleneck for drug discovery.

This breakthrough isn't just an academic achievement; it's a multi-trillion dollar opportunity for those agile enough to operationalize it. The discovery of a key protein linked to heart disease, directly facilitated by these advanced AI models, serves as a potent case study. This isn't just about faster research; it's about uncovering entirely new therapeutic avenues previously obscured by the complexities of biological systems. 🧬✨

The market is ripe for disruption. Incumbent pharma giants, while attempting to integrate AI, are often hampered by legacy systems and a slower pace of innovation. This creates a colossal arbitrage opportunity for nimble startups.

Furthermore, the advancements in 'artificial neurons' herald a new era of specialized computing for complex biological simulations, promising exponential gains in processing power and efficiency. This means we're not just improving existing processes; we're creating entirely new capabilities for understanding life itself.

The confluence of AI-driven discovery, specialized computing, and the critical need for secure, governed AI deployments (as highlighted by AWS Bedrock's fine-grained access control solutions) forms a singular, generational investment thesis.

The future of medicine will be written in code, and the first movers will own the pen. ✍️💲

🚀 The Disruptor's Playbook: Entry Strategy

Minimum Viable Product (MVP): The 'Target Identifier' AI Platform

Founders, your immediate play is to build a specialized, cloud-native AI platform that leverages the principles demonstrated by AlphaFold and similar models. This MVP, let's call it 'BioTarget AI,' focuses on identifying novel therapeutic targets and designing preliminary lead compounds for specific, high-value disease areas. Forget building a general-purpose protein predictor; specialize and dominate. 🎯

MVP Specifics:

Phase 1: Precision Oncology Target ID: Focus on an under-addressed cancer subtype. Use proprietary or publicly available genomic, proteomic, and clinical data to train custom AI models (building on concepts from AlphaFold) to predict novel protein-protein interactions or druggable pockets unique to that cancer. The output is a ranked list of novel therapeutic targets with predicted binding characteristics for small molecules or biologics.

User Interface (UI): A secure, intuitive web interface allowing biotech researchers to upload specific disease markers and receive AI-generated target insights.

API Integration: Offer an API for seamless integration with existing R&D pipelines of early-stage biotechs or academic labs.

Steps to Rule the Market and Displace Incumbents: 👑

Specialization & Data Moat: Start hyper-focused (e.g., heart disease-specific protein interactions, like the recent DeepMind discovery). Acquire or license unique datasets in your chosen niche. The more proprietary data you feed your specialized AI, the stronger your predictive power and defensible moat.

Agile Iteration & Validation: Unlike big pharma's multi-year R&D cycles, rapidly iterate your AI models and validate predictions through in-vitro partnerships with academic or contract research organizations (CROs). Publish your validation results (selectively) to build scientific credibility.

Secure & Compliant Deployment: Implement robust fine-grained access control and data governance from day one, akin to AWS Bedrock AgentCore's capabilities. Biotech data is highly sensitive. Offering assured security and auditability (addressing 'LLM honesty' concerns in a biotech context) will be a significant differentiator against less mature AI offerings.

Strategic Partnerships & Licensing: Avoid direct drug development initially. Instead, partner with smaller biotech firms or academic institutions to license your AI-identified targets or lead compounds. Your value proposition is accelerating their pipeline with high-confidence candidates, drastically cutting their early-stage R&D costs and timelines.

Leverage Neuromorphic Computing: As artificial neuron technology matures, strategically integrate or plan to integrate these specialized chips. This will allow your platform to process vastly more complex biological simulations with unprecedented speed and energy efficiency, offering a competitive edge that traditional cloud compute cannot match. Position this as your next-gen advantage. 🧠⚡

Acquisition Target Positioning: Build your company to be an indispensable 'AI-as-a-Service' layer for drug discovery. Your high-accuracy, rapid-discovery capabilities will make you an attractive acquisition target for big pharma looking to leapfrog their internal AI efforts or for large tech companies (like OpenAI with Neptune) seeking to expand their vertical AI offerings.

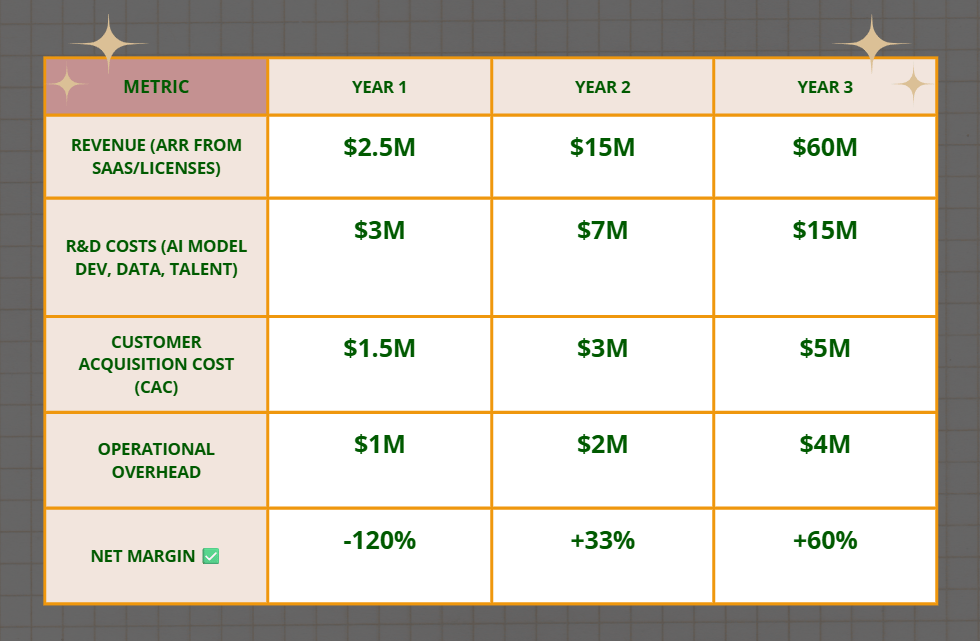

📊 Projected P&L (Year 1-3)

⚠️ Risk Analysis

While the opportunity is immense, significant risks must be navigated. 🚧

Regulatory Hurdles: Drug discovery is a highly regulated field. While BioTarget AI focuses on early-stage identification, any link to clinical outcomes or intellectual property will invite intense scrutiny. Early engagement with regulatory experts (e.g., FDA, EMA) and building regulatory-compliant data pipelines are crucial.

Computational & Data Scale: Training sophisticated protein folding and binding models requires massive computational resources and access to vast, diverse, and high-quality biological datasets. Securing compute credits, cloud infrastructure partnerships, and data licensing agreements will be ongoing challenges.

Competition from Incumbents: Google DeepMind, AWS, and major pharmaceutical companies are heavily investing in this space. Your edge must be hyper-specialization, superior data access, and rapid execution that large organizations struggle to replicate.

Talent Scarcity: The convergence of advanced AI, machine learning engineering, and deep biological expertise is a rare commodity. Attracting and retaining top-tier talent will be fiercely competitive.

Technical Validation: AI predictions, especially in biology, require rigorous experimental validation. Ensuring the highest possible accuracy and interpretability of your models will be key to building trust and securing partnerships.

Intellectual Property & Licensing Complexities: Navigating the IP landscape for AI-discovered targets or compounds, especially when multiple parties are involved, can be complex. Clear legal strategies for IP ownership and royalty structures are essential. 🛡️🔐