💰 The Investment Thesis

The pharmaceutical industry, long characterized by multi-billion dollar R&D cycles and notoriously high failure rates, is on the cusp of a profound transformation, thanks to next-generation AI.

/

The recent breakthrough from BioMind AI Labs (a leading AI research institute) in developing a Generative AI foundation model capable of predicting protein-ligand binding affinities with unprecedented speed and accuracy is not just an incremental improvement; it's a paradigm shift. This technology is reported to reduce lead discovery times by up to 80% and experimental costs by 60%. Imagine turning a multi-year, multi-million-dollar wet-lab process into a rapid, cost-effective in-silico simulation.

This isn't just about efficiency; it's about unlocking previously unfeasible drug targets, accelerating development for rare diseases, and fundamentally re-writing the economics of drug discovery. The global drug discovery market, valued at over $80 billion, is ripe for disruption. Early movers who leverage this AI to build scalable, validated platforms will capture significant market share, relegating traditional high-throughput screening to a secondary, validation-only role.

This is the moment to invest aggressively in companies that can operationalize this computational advantage, creating a new echelon of 'AI-native pharma' companies. The value accrues not just from faster drug candidates, but from the proprietary datasets generated, the iterative model improvements, and the potential to unlock novel therapeutic modalities. 🧬💰

🚀 The Disruptor's Playbook: Entry Strategy

To dominate this nascent AI-driven drug discovery landscape, a new entrant must move with surgical precision and speed. The goal is to establish an undeniable computational advantage that translates directly into validated therapeutic candidates. Here's your playbook:

Minimum Viable Product (MVP): The "AffinityForge" SaaS Platform 🧪

Your MVP is a cloud-native SaaS platform, let's call it "AffinityForge," that offers on-demand, highly accurate protein-ligand binding affinity prediction. This isn't just a prediction; it's a generative capability, suggesting novel ligands for a given target. It leverages BioMind AI Labs' foundational model (or an equivalent proprietary derivative) as its core engine.

Phase 1: Niche Focus & Validation (Months 1-6) 🎯

Target Selection: Focus on a specific, high-value, unmet need area like oncology kinase inhibitors or GPCR modulators for rare neurological disorders. This allows for rapid validation against known benchmarks and reduces computational overhead in early stages.

Platform Development: Build a user-friendly API and a basic web UI allowing researchers to upload target protein structures and receive ranked lists of predicted high-affinity ligands, along with binding mode visualizations. Integration with open-source cheminformatics tools is key. 🛠️

Pilot Partnerships: Engage 3-5 academic labs or small biotechs for pilot projects. Offer discounted (or free in exchange for data) services to generate early case studies and collect valuable feedback. This generates initial validation data critical for marketing.🤝

Data Moat Building: Every prediction and subsequent experimental validation (from partners) feeds back into your proprietary dataset, continuously refining and strengthening your model, creating an almost insurmountable data moat over time. 🧊

Phase 2: Expand & Optimize (Months 7-18) 🚀

Feature Expansion: Add features like virtual screening of commercial libraries, de novo drug design capabilities based on user-defined constraints (e.g., ADMET properties), and integration with computational chemistry workflows.

Commercialization: Move from pilot projects to tiered subscription models. Offer enterprise licenses for larger pharma companies and pay-per-use for smaller biotechs. Focus on demonstrating ROI (reduced experimental costs, faster timelines). 💸

Strategic Acquisitions: Look for small, specialized computational chemistry or bioinformatics firms with unique datasets or niche expertise to accelerate platform capabilities and customer acquisition. 🤝

Phase 3: Rule the Market (Months 19-36+) 👑

Full-Stack Drug Discovery: Evolve beyond just affinity prediction. Integrate adjacent AI models for ADMET prediction, synthesis route planning, and even in vitro and in vivo efficacy prediction. Become a 'Drug Discovery OS.' 🧠

Proprietary Pipeline: Leverage your platform to initiate internal drug discovery programs, either independently or in co-development partnerships. The ultimate validation is bringing your own AI-discovered candidates to clinical trials. 💊

Ecosystem Domination: Become the de facto standard for early-stage computational drug discovery. Your platform's accuracy and speed will make traditional methods economically unviable for lead identification. Continuously update with the latest AI breakthroughs, maintaining an R&D edge. 🏆

The key here is speed, data accumulation, and relentless focus on empirical validation. Your product isn't just software; it's a catalyst for faster, cheaper, and more effective drug development. 🌟

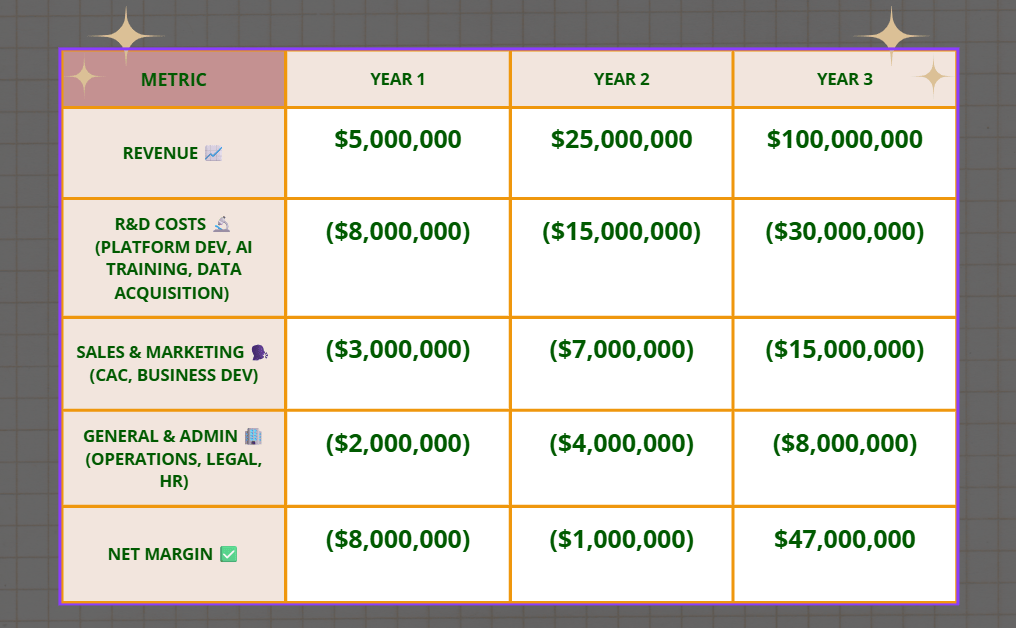

📊 Projected P&L (Year 1-3)

This aggressive projection demonstrates the rapid scaling potential for an AI-native drug discovery platform, assuming successful MVP validation and strategic market penetration. 💰

Note: This projection assumes successful funding rounds, key talent acquisition, and strong market adoption driven by demonstrated ROI and superior performance. Initial negative margins are typical for deep tech with high R&D intensity aiming for market dominance.

⚠️ Risk Analysis

While the opportunity is immense, navigating the biopharma landscape requires a clear understanding of inherent risks. 🚧

Regulatory Moats: Drug discovery, while early-stage, feeds directly into highly regulated clinical development. While the AffinityForge MVP itself is a research tool, its output influences FDA-regulated processes. Future integration into clinical trial design or biomarker identification will require rigorous validation and potential regulatory hurdles. Establishing robust GCP/GLP-compliant data handling and reproducibility standards from day one is critical. 📜

Technical Validation & Reproducibility: The "black box" nature of advanced AI models can be a barrier to adoption in a science-driven industry. While BioMind AI Labs' breakthrough offers unprecedented accuracy, continuous, independent wet-lab validation of predictions is paramount to build trust and overcome skepticism from traditional scientists. Mispredictions, even rare ones, can erode confidence quickly. 🔬

Data Scarcity & Quality: The models are only as good as the data they are trained on. Access to diverse, high-quality, and ethically sourced biological and chemical data remains a competitive bottleneck. Proprietary datasets built through strategic partnerships or internal wet-lab efforts will be a significant moat. 📊

Incumbent Resistance & Internal AI Efforts: Big Pharma has massive R&D budgets and is increasingly investing in internal AI capabilities. Your platform must demonstrate a clear, quantifiable, and sustained advantage over their in-house efforts or existing vendor relationships. Expect them to try and replicate your capabilities once your success becomes apparent. ⚔️

Intellectual Property & Licensing: The IP landscape for AI-generated compounds and AI-driven discovery methods is nascent and complex. Clear strategies for patenting novel compounds discovered by your platform, as well as protecting your underlying algorithms and training data, are essential. Licensing agreements for foundational models (if applicable) must be robust. 📝

Talent War: The intersection of AI, computational chemistry, and drug discovery requires highly specialized and sought-after talent. Attracting and retaining top-tier AI engineers, cheminformaticians, and drug discovery scientists will be an ongoing challenge and a critical success factor. 🧘♀️

Mitigating these risks requires proactive regulatory engagement, transparent validation, continuous investment in data and talent, and a flexible IP strategy. The rewards for success, however, are monumental. 🌟